Share

The aviation industry is gearing up to deal with the new realities of the post-COVID-19 world, and as the saying goes, “Crisis breeds innovation.” Airlines are also ready for more out-of-the-box solutions to cater to their aircraft acquisition needs.

The commercial airline landscape is rapidly changing, and to accommodate the new rules of profitability, the traditional methods of acquiring an aircraft like the long-term operating lease or finance lease may no longer be enough to create a chance for small to mid-size and/or start-up airlines to carry on to a successful operation.

The typical leasing companies have traditionally been offering aircraft on longer term which requires a commitment of six, eight or more years and are governed by water-tight contracts with almost non-existing exit options. Similarly, the commitment in a finance lease can be overbearing, especially in this VUCA economic environment, where the passenger volume is not expected to return to 2019 levels until 2024. IATA forecast that passenger numbers are expected to grow to 2.8 billion in 2021. This is a billion more than 2020, but still 1.7 billion short of 2019 performance. Airlines have already cut costs by 45% and revenues are down by 60%. And given the above, the road to recovery will be slow.

With this in mind, Air Charter International, a 25-year-old aviation services provider, have introduced an innovative option for aircraft leasing, which provides flexible solutions to our clients across the globe: The Operator to Operator (O2O) Short Term Aircraft Dry Lease.

Key Points to Know about Dry Leasing

- Dry Leasing: How Does It Work?

- Benefits of Dry Leasing

- Challenges to Expect from Dry Leasing

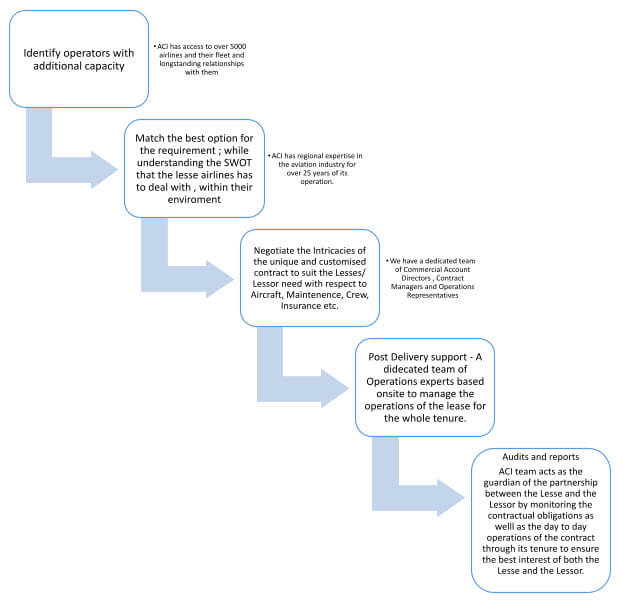

- Step-by-Step Dry Leasing Services

How It Works

The operators with additional capacity can enter into a sublease contract with another airline to lease out their owned aircraft for as short as a six-month period. The aircraft registration goes under the Lessee AOC.

The lease can be attached with the pre-existing components of maintenance contracts and insurance, and the lessor undertakes to pass on the same to the lessee if suitable. This way, the lessee gets the benefit of a more turnkey solution of an aircraft lease.

Benefits at a glance:

- Shorter lease term against conventional 6-, 10- or 12-year terms

- Fixed and power by the hour (“PBH”) rentals or conventional fixed with MRs

- MRs through Letter of Credit with yearly escalations

- Option for existing maintenance service providers’ support to continue with the program post lease

- Crew training support from existing operator

- Lower security deposit

- Onsite support from ACI’s ops team

Challenges

- Most of the head lessors are reluctant for a sublease, which makes this option way more suitable for owned aircraft which reduces the pool of available aircraft.

- Rules and regulations: Civil aviation authorities across the world will play a big role in making this a norm. There are still many barriers to cross.

- Change management: As has been the case, the concept is new and it will thus take a while for the industry to adjust to innovative solutions.

What We Do

Should you need any more information, please feel free to contact our team of industry experts at ACI. Write to us at leasing@aircharter-international.com.

Author bio:

Stuart Wheeler is the CEO of Air Charter International (ACI). Established in 1994 and based in Dubai, ACI is an aviation services provider with a dedicated team of aviation specialists focused on delivering professional aircraft lease and charter services to the following regions – Africa, Arabia, Asia, Asia Pacific, Europe and the Americas.